Alex Rees July 25, 2025

Collected at: https://datafloq.com/read/how-ai-and-graph-analytics-are-transforming-compliance-monitoring/

Legacy AML systems rely on static rules and siloed data, which often result in excessive false positives and slow investigations. As money laundering tactics grow more sophisticated, compliance must evolve too.

The Financial Action Task Force emphasizes that digital transformation in AML is essential to meet today’s challenges. Their guidance promotes the use of machine learning, data aggregation, and real time analytics to enhance detection and reduce system abuse.

Mapping Risk with Graph Based Machine Learning

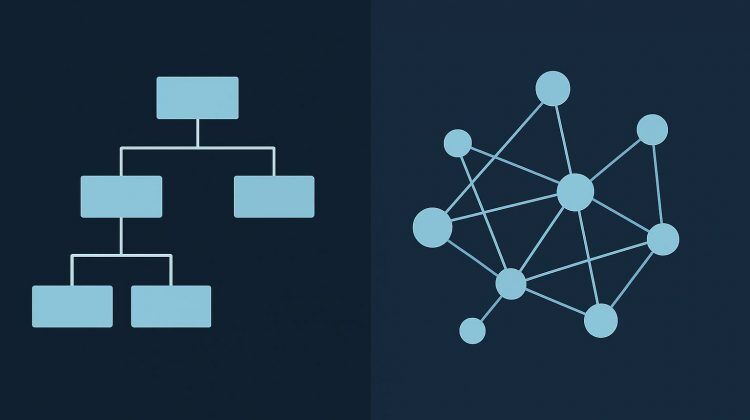

Rather than viewing transactions in isolation, graph based AI models analyse entities and their relationships, who is transacting with whom, when, and how often. Research published on arXiv demonstrated that applying graph neural networks to transaction monitoring reduced false positives by over 80 percent. These models uncovered hidden risk structures that linear models missed by identifying connections between accounts, counterparties, and typologies. Complementing this, a ResearchGate paper on enhancing AML with graph neural networks showed how knowledge graphs can dramatically increase the visibility of complex laundering schemes. These capabilities are explored further in Transaction Monitoring: Why Getting Risk Right Is the New Compliance Priority, which highlights how typology-driven scoring and behavioural context are redefining risk detection.

Moving Beyond Static Rules and Thresholds

Traditional systems generate alerts based on simple thresholds, like transaction size or jurisdiction. While useful, these rules often lack nuance. Machine learning enables typology based alerting, scoring alerts based on patterns that resemble known money laundering behaviours. Instead of asking “Is this transaction large?”, systems ask “Does this behaviour match structuring or layering tactics?” The IMF’s official commentary on AI and RegTech explains how modern compliance systems can use machine learning and explainable logic to scale risk detection, improve auditability, and reduce friction in operations.

Understanding Customer Behaviour with Network Context

Modern AML efforts depend not only on transactions, but on understanding the relationships behind them. Analysts now use entity resolution and network maps to visualize how customers, accounts, and transactions interact over time. Customer Network Maps: A Future Ready Solution for AML CRM Integration explores how network views improve both investigative efficiency and risk scoring. These visualizations help identify collusion, indirect exposure to sanctioned entities, or abnormal payment chains.

Real Time Learning and Continual Model Adaptation

To keep up with constantly changing threats, AML systems need to learn continuously. Rather than retrain models from scratch, modern systems use incremental learning to retain accuracy while adapting to new behaviours. A study on continual graph learning for AML detection demonstrated how adaptive models maintain precision in high volume environments without catastrophic forgetting. Further advances are discussed in Regulatory Graphs and GenAI for Real Time Transaction Monitoring, which showed how combining graph learning with AI-generated explanations can yield F1 scores above 98 percent – offering scalable insight for regulators and compliance teams alike.

Conclusion

AI and graph analytics are shifting transaction monitoring from static rule engines to intelligent, context-aware systems. These technologies enable real time decisions, reduce false alerts, and empower compliance teams to focus on genuine risk. For institutions facing growing scrutiny and pressure to modernize, the future of AML lies in adaptive learning, connected intelligence, and explainability at scale.

Leave a Reply